Capital Insights: Is AI a Paradigm Shift for Business? [March 2024]

Mar 13 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the March 2024 edition of Capital Insights!

This month, we’re discussing artificial intelligence and asking: will it be a true game-changer for major companies and their investors, or is AI just the next logical step forward in technology?

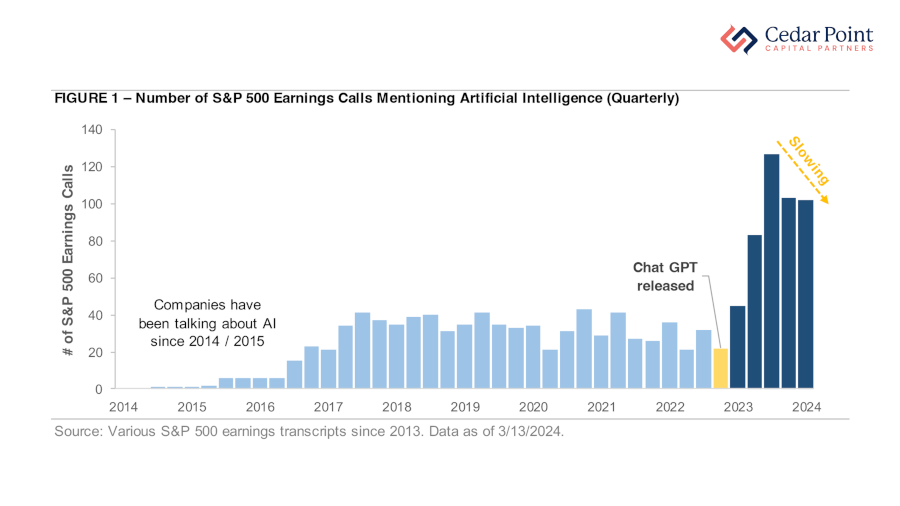

Now, when OpenAI released ChatGPT to the general public back in November of 2022, generative artificial intelligence became the worldwide buzz. As you’ll see in this month’s chart, the interest in AI was also reflected in quarterly earnings calls for many companies in the S&P 500.

Taking a look at Figure 1, transcripts from those earnings calls indicate that mentions of terms “artificial intelligence” and “generative AI” doubled in the quarter after ChatGPT’s release, and nearly doubling again the following quarter. Those mentions peaked in the third quarter of 2023, when a total of 127 of the S&P 500 constituent companies made at least one broad reference to AI.

The chart also reveals another interesting insight: S&P 500 companies have been discussing artificial intelligence for nearly a decade.

For instance—Johnson & Johnson, known better as a global pharmaceutical company than as an advanced technology company, said on one of its earnings calls, “Artificial intelligence, machine learning, and advanced sensors are creating new opportunities to take advantage of the best clinical and wellness expertise.”

That comment sounds like it could be from 2024, but was actually shared in 2015.

The point to all of this being that while it is clear that in the last ten years, artificial intelligence has become increasingly mainstream, discerning analysts are wisely asking: is this a generational paradigm shift in the way businesses operate, or is just promising, but premature hype? Investors will need to be equally discerning on AI when it comes to their own investment strategies.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.