Capital Insights: Can the Stock Market Keep its Run Going? [July 2024]

Jul 19 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the July 2024 edition of Capital Insights!

This month, we’re taking a look at the stock market’s impressive run in the first half of this year, and whether it can maintain that momentum into the second half.

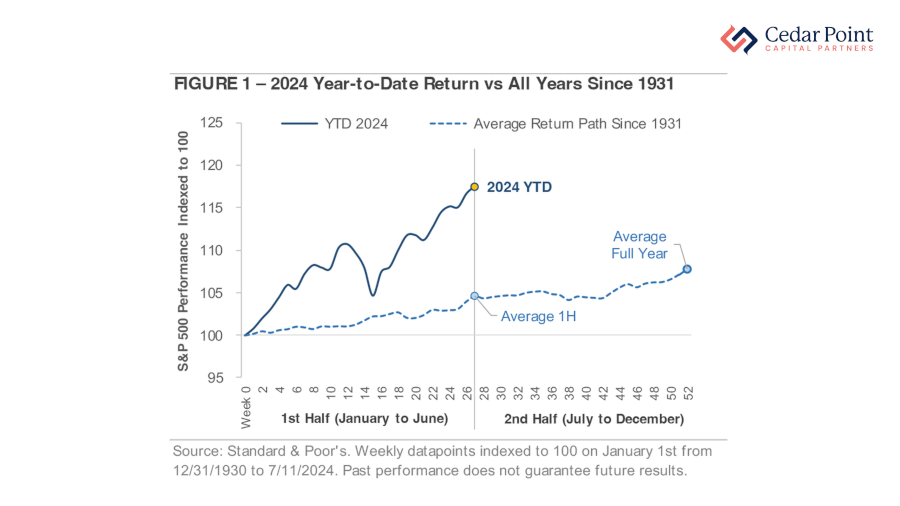

If we take a look at the S&P 500 Index, we can see just how well US equities have fared in 2024.

Despite a bumpy April, the index set many new all-time highs throughout Q1 and Q2 and gained 15% through the end of June. That’s more than 7% above the long-term average full year return and represents its 16th strongest start since 1931.

But can the S&P 500 Index continue to trade higher in the back half of 2024? Well, history suggests the potential is there.

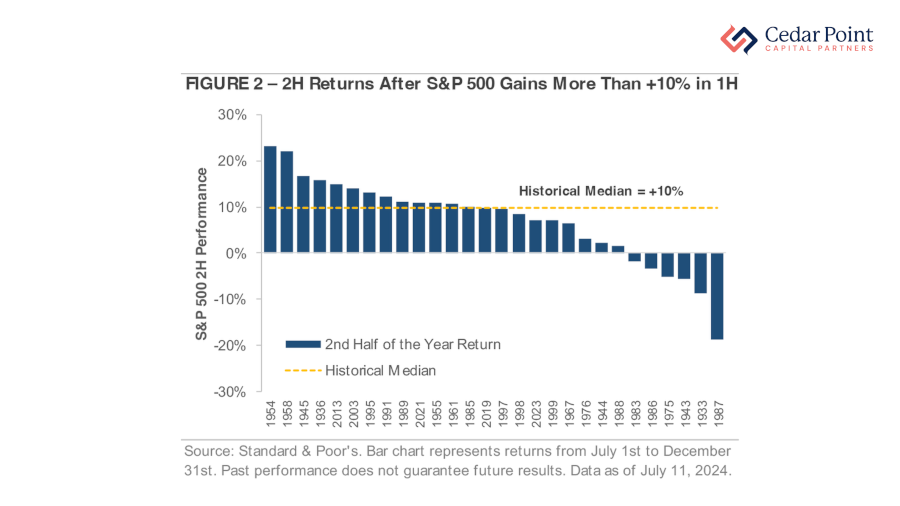

Again, with our data set going back to 1931, in the 28 years that the S&P 500 gained 10% or more in the first half, the index continued to trade higher nearly 80% of the time for the balance of that year.

In 13 of those 28 years, it gained more than 10% in the second half. And if we exclude 1987, marked by the historic Black Monday Crash in October of that year, only three other years in our population produced a second-half loss of more than 5%.

One explanation for this phenomenon points toward human nature itself. Investors tend to think in terms of calendar years, and often feel compelled to chase the market in the second half. After all, no one wants to underperform when the market is rallying.

Also, investors may be reluctant to sell after a strong first half to avoid realizing short-term capital gains and potentially paying a higher tax rate versus holding on to their gains for at least one year.

Of course, the calendar for the rest of the year is full of market-moving events, from the first potential interest rate cut to the presidential election. We’ll be watching these events and the economic data for shifts in the market, but for now, history suggests the S&P 500 has more room to run in the back half of the year.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.