Capital Insights: The Complex Picture Facing the Fed

Feb 21 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the February 2025 edition of Capital Insights!

This month, we’re taking a look at the Federal Reserve's recent decision to hold interest rates steady, and what may be influencing their outlook as we move further into 2025.

Now, as loyal viewers of Capital Insights know, investors keep watchful eyes on the Federal Reserve because the decisions it makes tend to shape and influence our overall economic environment. The central bank has two main mandates: price stability and full employment.

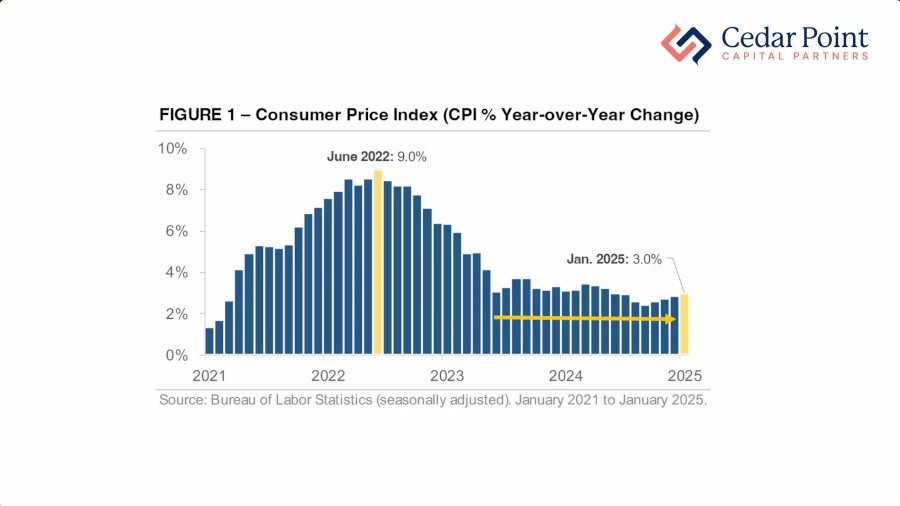

The balance between these goals seems to have shifted recently. How so? Take a look at Figure 1.

Here we can see year-over-year changes in the Consumer Price Index, which measures how the price of goods and services adjust over time.

In January, CPI rose by half a percent from December, the largest one-month increase since August 2023. That move pushed the annual inflation rate back to 3%, and reignited concerns that inflation could remain above the Fed’s 2% target for longer.

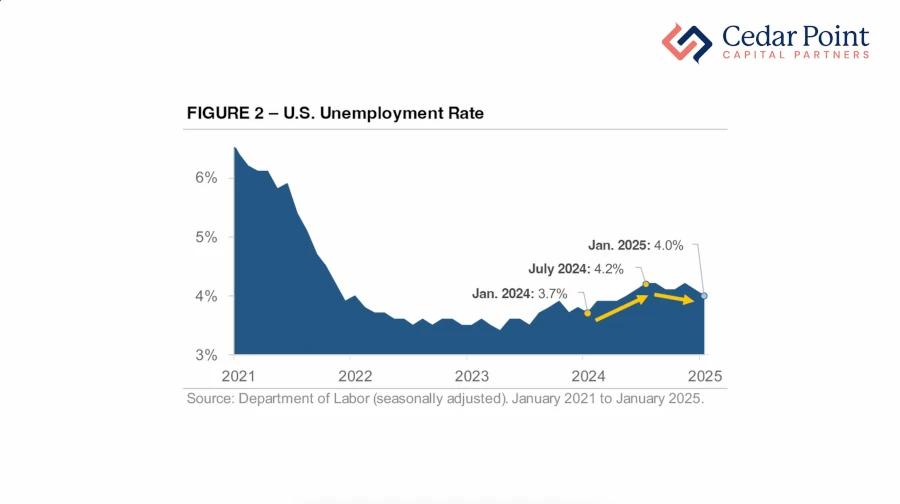

Now, let’s take a look at unemployment.

In January, U.S. unemployment fell slightly to 4%, the lowest percentage since May 2024. Employers added approximately 143,000 jobs for the month, and with positive numbers from November and December, there are indications that the labor market isn’t weakening as much as previously thought.

So, what do these charts tell us about where the economy may be headed? Well, it’s extremely hard to say with any certainty, but the slight shift in data we are seeing underscores the complex economic landscape facing the Fed and markets.

To review, the Federal Reserve began cutting interest rates in 2024 as its focus shifted from reducing inflation, to supporting the labor market. However, with inflation progress stalling and labor markets holding firm, many believe the Fed will pause its rate-cutting cycle until there’s more clarity.

The Fed itself has signaled a more patient approach, and market expectations have adjusted accordingly. As of this recording, the next rate cut is now not expected until June, at the earliest, and that could very well impact investors’ plans as we move into the back half of the year—something we will undoubtedly be keeping a close eye on.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.