Capital Insights: Does Trump 2.0 Equal Markets 2.0? [Nov. 2024]

Nov 22 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the November 2024 edition of Capital Insights!

This month, we’re looking at early expectations for the economy with President Donald Trump’s re-election and offering our views on why Trump 2.0 doesn’t necessarily mean Markets 2.0.

Post-election, investors have been looking to Trump’s first term as a roadmap for how the administration’s policies may impact markets.

Early market returns since November 5th seem to signal that investors expect a repeat of Trump’s first term.

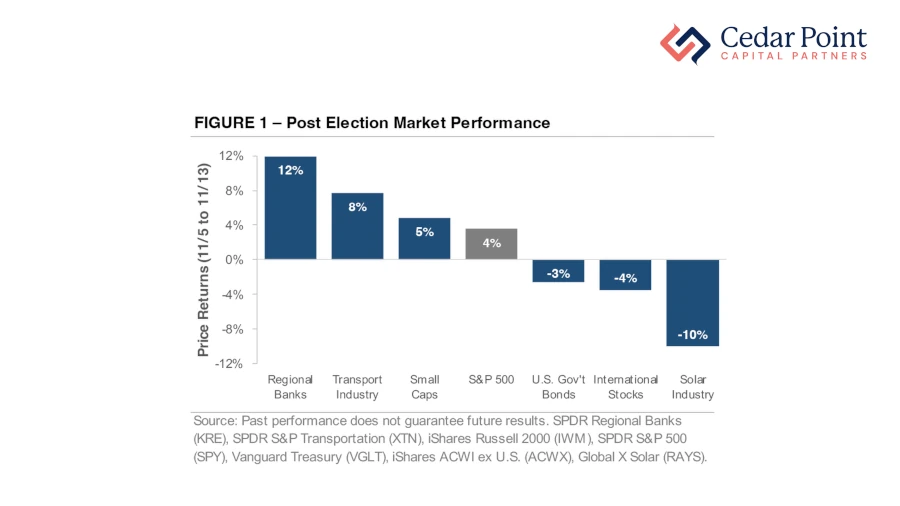

Now as of this recording on November 14, 2024, Figure 1 shows that bank stocks are rising on hopes of deregulation, and small-caps are higher on expectations for tax cuts.

In contrast, international stocks have fallen due to concerns surrounding potential tariffs. And renewable energy stocks are also lower, with investors expecting Trump to roll back clean energy subsidies.

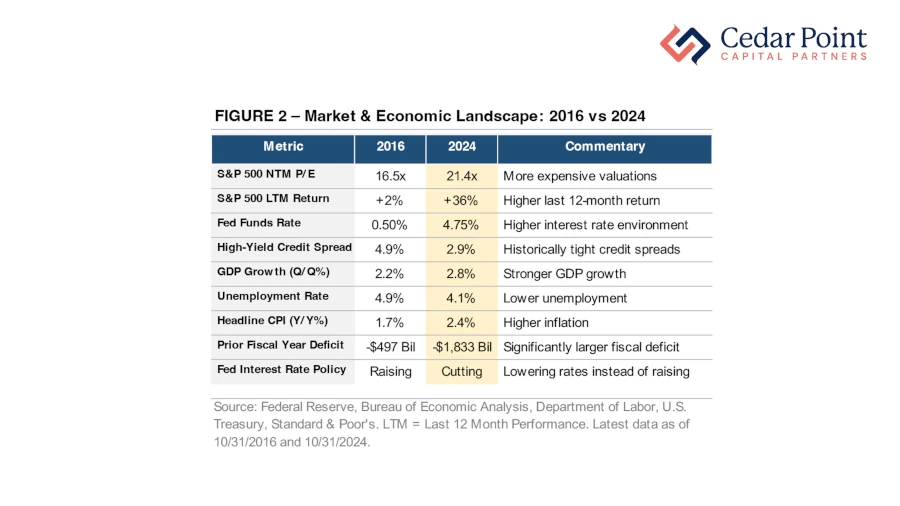

The interesting thing, however, is that economic, monetary, and fiscal landscapes have all changed significantly since the beginning of his first term in the White House. Check out Figure 2.

As you can see here, in 2016, the economy was sluggish—today, growth is stronger, unemployment is lower, and the federal budget deficit is bigger.

The Federal Reserve is cutting interest rates rather than raising them, and the COVID-19 pandemic has since reshaped the global economy. Stock valuations are more expensive, and credit spreads are tighter, suggesting markets are fully priced, with little to no expectations for an economic slowdown in the near term.

Overall, the market appears to be in “copy-paste” mode, using Trump’s first term to guide investment decisions. Just remember that investing is rarely that straightforward. The next Trump administration will impact markets, but fundamentals and economic data will continue to be the primary drivers. The president is the same, but the economy and markets are not.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.