Capital Insights: Forecasting the Next Interest Rate Cut [May 2024]

May 23 2024 | Back to Blog List

VIDEO TRANSCRIPT

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the May 2024 edition of Capital Insights!

This month, we’re looking at interest rates, inflation and the ever-changing expectations for rate cuts this year.

This May marks 10 months since the Federal Reserve last raised interest rates.

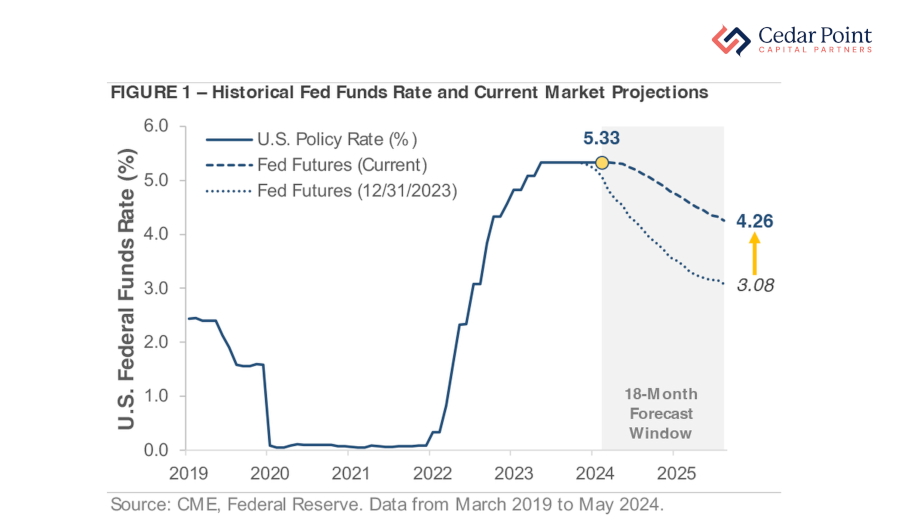

As we see here in Figure 1, that follows a 17-month stretch where the central bank raised its benchmark rate by over 500 basis points, pushing past 5 percent for the first time in over 15 years.

This period represents the most-aggressive rate-hike campaign in decades, undertaken to fight the high inflation levels experienced post-pandemic. But with price pressures moderating, investors are now waiting for the Fed to reverse course. Markets expected cuts starting in March, but it’s now mid-May, and the Federal Funds Rate is still north of 5%.

So, what’s holding the Fed back? Well, two things: Inflation and employment data.

Remember that our central bank has two primary objectives: price stability and full employment. It uses higher interest rates to fight inflation, and lower interest rates to stimulate the economy as unemployment rises.

With inflation higher than expected in Q1, and unemployment still below 4%, Fed officials chose to keep the focus on fighting inflation.

Over the past month, markets began placing a higher probability of only one rate cut in 2024 – happening in December. This represents significantly lowered expectations from the six cuts expected at the start of the year. And if this latest forecast is accurate, it means a total of 17 months will have passed between the last rate hike and the first rate cut.

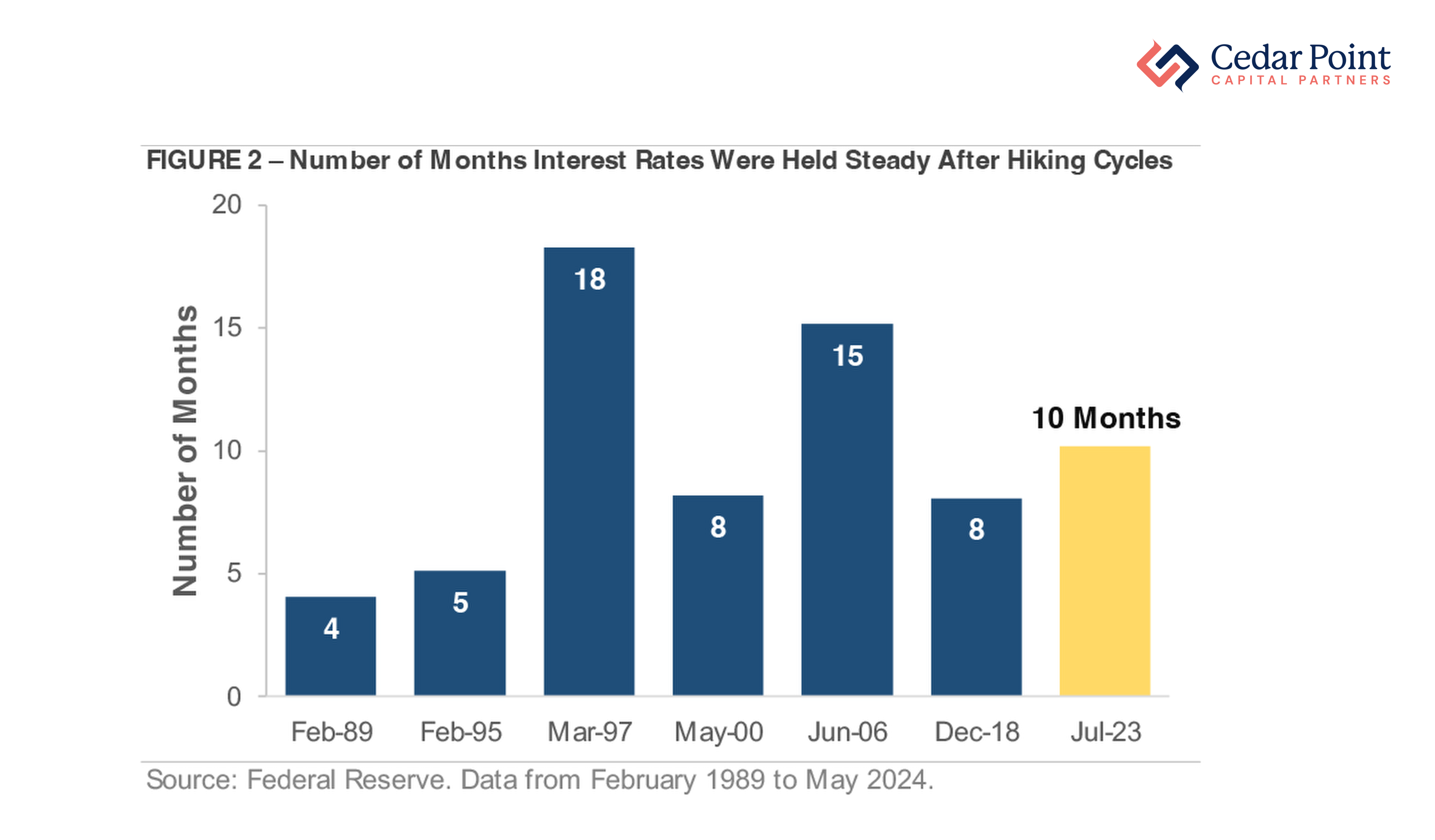

So, how does that compare historically?

As you can see in Figure 2, these “pause” periods have ranged from as short as four months to as long as 18. Compared to prior cycles, the current 10-month pause is longer than average, but certainly not unprecedented.

May’s inflation reading was the lowest since April of 2021. If the economy can keep that rate of inflation growth low, it’s likely that we could see rate cuts could begin sooner than later.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.