Capital Insights: Keep Politics Out of Your Portfolio [Sept. 2024]

Sep 19 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the September 2024 edition of Capital Insights!

This month, we’re talking politics—specifically, why investing based on your politics is generally a bad idea for your portfolio.

The presidential election is only weeks away at this point, and Americans are preparing to vote in what is likely to be a close race. That has led to a lot of questions about how the outcome might influence markets, and whether it should necessitate a change to your financial strategy.

The short answer to that question is no, it is generally not in your best interest to make changes to your portfolio based upon an election. And here’s why.

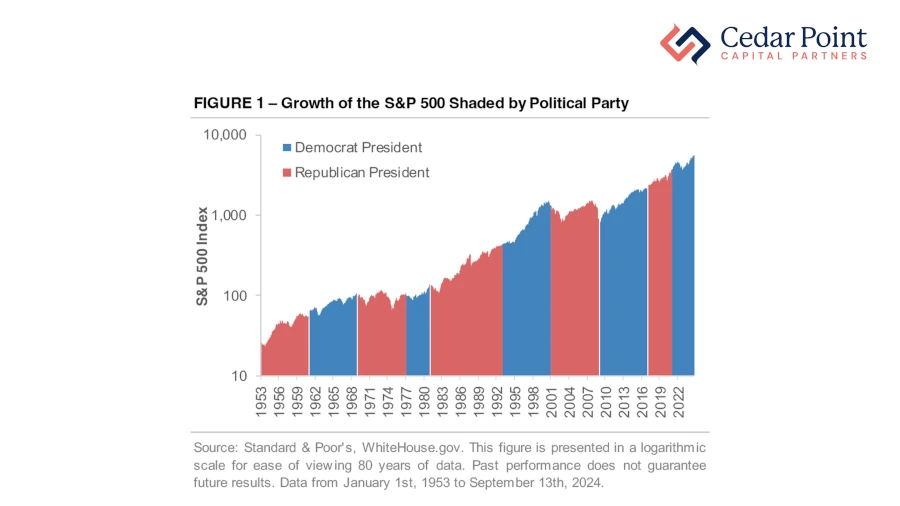

We know elected leaders can influence economic growth by enacting new laws and regulations, but the historical data suggests that whoever sits in the White House has little to no impact on investment performance. Don’t believe me? Take a look at Figure 1:

Here we see the logarithmic representation of growth of the S&P 500 Index since 1953, color-coded by major political party occupying the White House.

The fact is, fundamentals - like corporate earnings and valuations - tend to impact the stock market far more than political headlines.

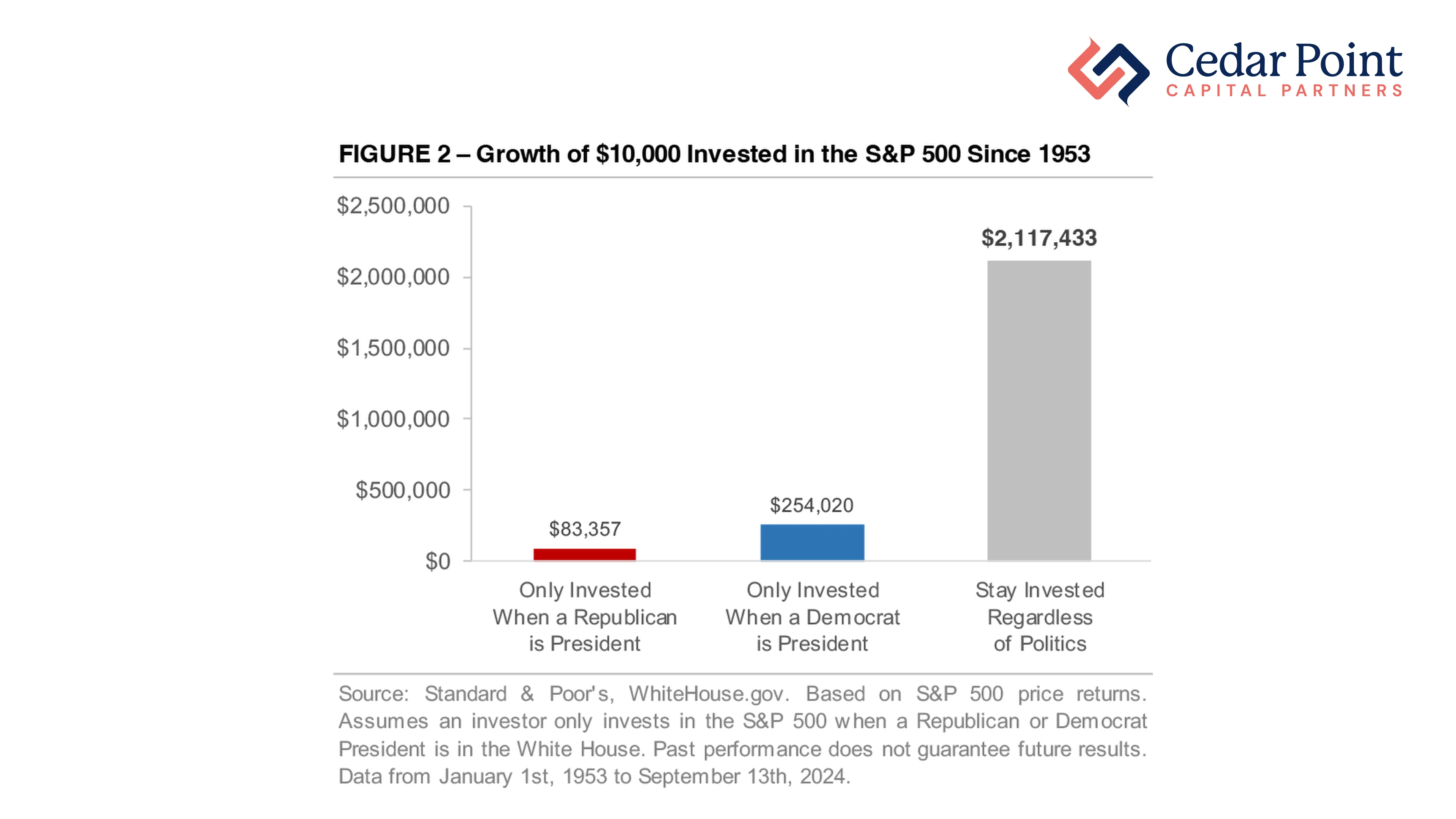

In fact, the financial impact of allowing your political leanings to influence your investments can be really detrimental to your goals. To illustrate, entertain us by assuming the following hypothetical:

Let’s say that you invested $10,000 in the S&P 500 starting in 1953, but, only when a Republican was president.

Figure 2 shows that amount would have grown to around $83,000 today, excluding reinvestment of dividends. Now doing the same, but only with Democratic presidents, would result in about $254,000. But, staying invested regardless of the party in power, would have brought your total return to over $2.1 million.

Politics can stir strong emotions, but it’s better to focus on time-tested investment principles and avoid letting political views influence your decisions. The U.S. economy’s success and resilience doesn’t change with each election, and neither should your strategy.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.