Capital Insights: Tariffs, Turbulence & Your Portfolio

Apr 11 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the April 2025 edition of Capital Insights.

This month, we’re talking tariffs—a word that’s back in the headlines and sparking plenty of questions for investors.

To start, tariffs are essentially taxes on imported goods. They’ve long been used by countries to protect their key industries and influence trade negotiations.

But every so often, tariffs take center stage in market conversations, and that’s exactly what happened this month. On April 2nd, the Trump Administration unveiled a sweeping set of tariffs that includes a 10% rate on all imports, and further “reciprocal tariffs” targeting roughly 60 countries—which for the most part, have since been paused as of this recording.

As of April 10th, these tariff rates range from 20% for the EU all the way to a reported 145% on Chinese goods.

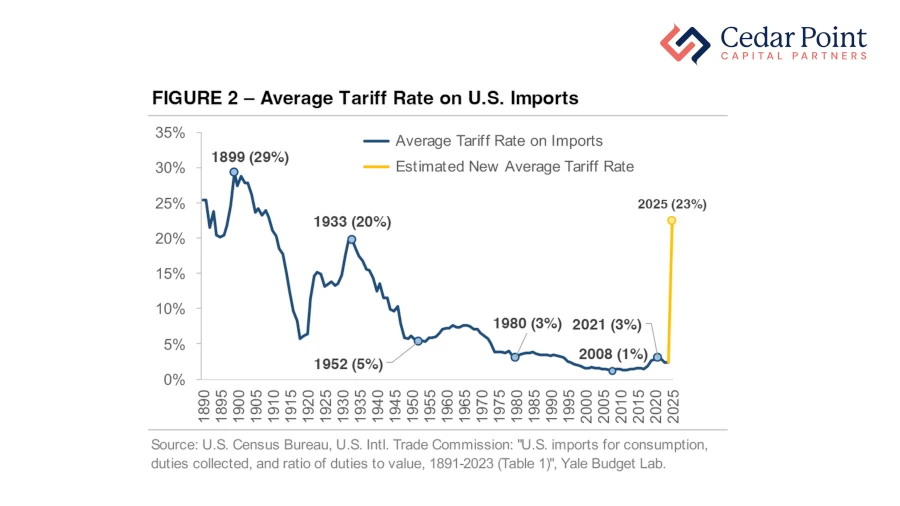

As we see here in Figure 2, these announcements are projected to push our average tariff rate far north—from less than 3% last year, to well over 20% according to The Yale Budget Lab—the steepest level in nearly a century.

As we already know, the tariff announcement shocked markets and sent equities reeling for some of their sharpest losses on record. Even after President Trump announced a 90-day pause on April 9th, global equity and fixed income markets continued to gyrate as investors tried to make sense of all of the ambiguity.

So, what does this mean for your investments and your portfolio?

The true, lasting impact of these tariffs, current and future, is unknown. In the near-term, economists hypothesize that businesses could absorb some of these additional costs, potentially softening their overall economic impact. However, there’s far less consensus about how the private sector will respond in the long-term, with wide-ranging potential effects to capital expenditures and labor demand, all possible.

Some tariffs may stay in place for years. Others could be negotiated away in a matter of months, weeks, or even days. Economic effects like higher inflations or slower growth are possible but given the complexities of global trade and the range of potential retaliatory responses from other countries, predicting the path from here is difficult.

Rather than reacting to headlines and market volatility, your best course of action is to stay focused on your financial plan, maintain a well-diversified portfolio, and make decisions in line with your long-term goals. History tells us that patient investors—those who stay the course through cycles like these—are often the ones rewarded over time.

If you have any questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.