Capital Insights: Understanding March's Market Selloff

Mar 14 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the March 2025 edition of Capital Insights!

This month, we’re breaking down the recent market selloff—what’s behind it, whether it signals deeper concerns, and what history tells us about market volatility.

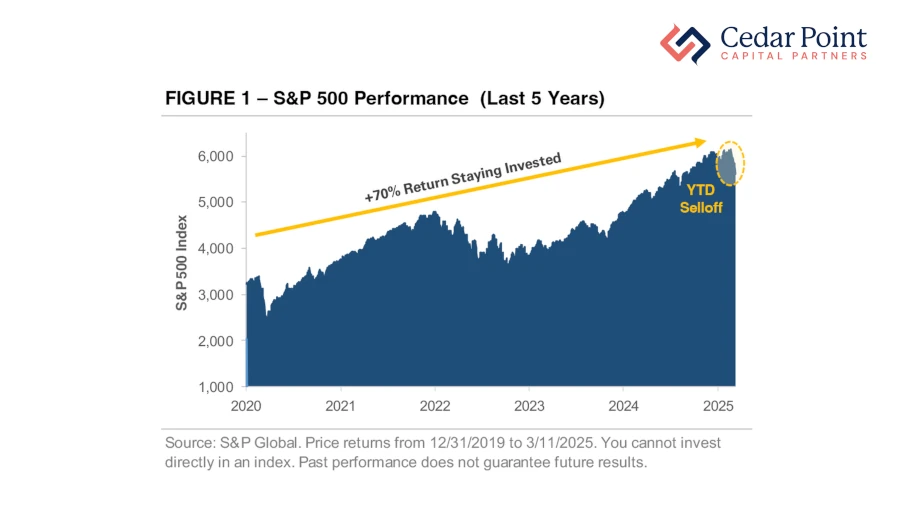

Now, stocks began the year on a strong note. But since then, we’ve seen a sharp reversal in recent weeks. As of this recording on March 11th, the S&P 500 Index has declined over 8% from its all-time high on February 19th, bringing its year-to-date return down to -5%.

But let’s put this decline in perspective – take a look at Figure 1.

Here, we see the broader impact of the U.S. equity market recalibration over last few weeks, charted across the past five years’ price performance of the S&P 500 Index.

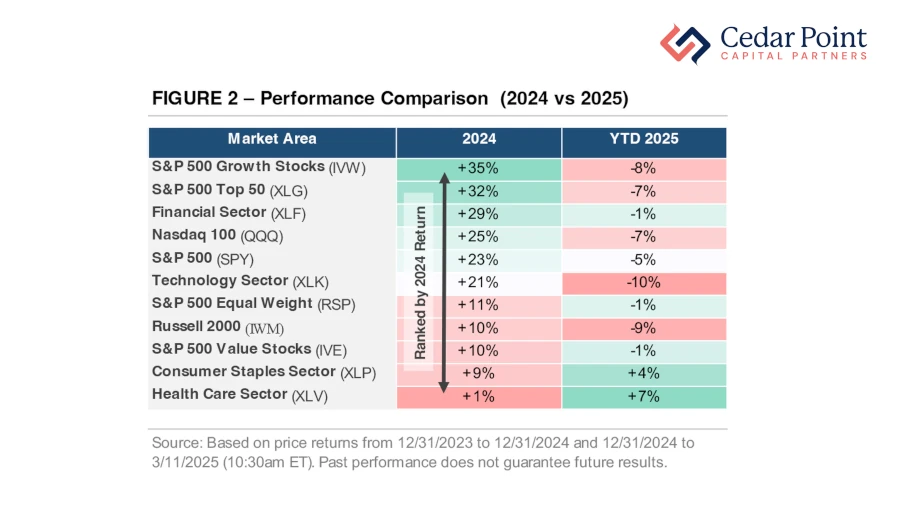

Similarly, the Nasdaq 100 Index, home to many technology and growth stocks, is down 7% year-to-date, while the small-cap Russell 2000 Index has dropped 9%. But taking the cake, the group of tech stocks—often referred to as the Magnificent 7—has fallen nearly 15% in 2025 alone.

So, what’s driving this market downturn? Well, there are a few key factors at play:

First, momentum stocks are reversing. The big winners of 2024—AI technology firms and large-cap growth companies—are now leading the decline.

As we see in Figure 2, many of last year’s top performers, including the Nasdaq 100 Index, are now this year’s biggest underperformers.

Second, investors are repositioning and deleveraging. At the start of 2025, investor exposure to stocks was at record highs, particularly among institutional investors like pension funds and hedge funds. As stocks have fallen, many are deleveraging, adding to the selling pressure.

Finally, consumers and businesses are facing big policy uncertainty. Optimism around the Trump administration’s pro-growth policies has shifted. There are now concerns that spending cuts and new trade tariffs could slow economic growth.

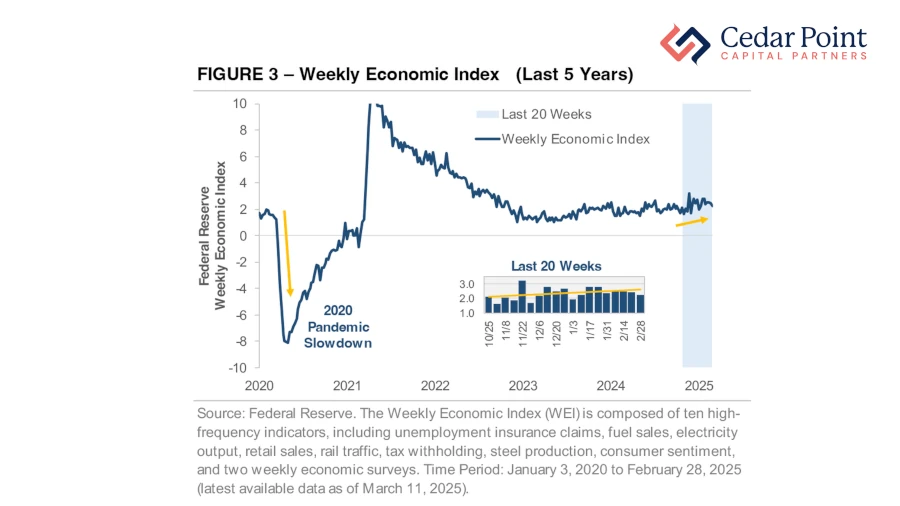

But in the end, it’s important to remember that the stock market is not the economy. Along those lines, and speaking of the economy, if we take a look at The Federal Reserve’s Weekly Economic Index (or WEI for short), we still see a readout showcasing a resiliently positive trend.

This tells us that despite the recent market turbulence, the economy appears to remain stable.

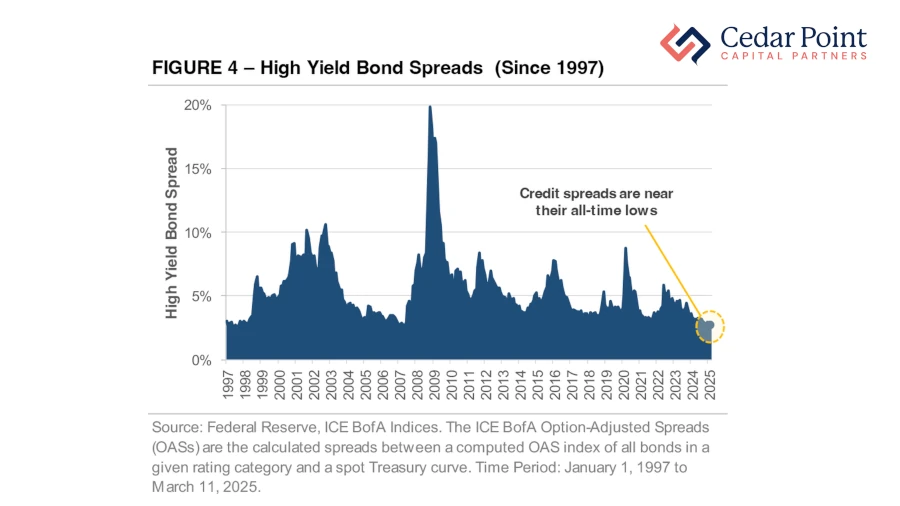

Additionally, we can look for further signals from the bond market. As we see here in Figure 4, high-yield credit spreads remain near all-time lows, suggesting the selloff is largely contained within stocks, rather than signaling a deeper financial strain.

Market corrections can be unsettling, but they are a normal part of investing. In fact, since 1928, the S&P 500 Index has experienced a decline of 5% or more in 91 of the past 98 years.

History shows that while selloffs test your confidence, staying invested and maintaining a long-term focus is the best approach over time.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, and I look forward to seeing you next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.