Capital Insights: Why Aren't Unemployment Rates Higher? [February 2024]

Feb 08 2024 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to the February 2024 edition of Capital Insights!

This month, we’re taking a look at the labor market, and why unemployment rates haven’t seemed to rise, as traditionally expected, under the recent higher interest rate regime.

Few economic measures receive as much attention as the unemployment rate – it’s one of our main measures of the labor market and the economy. It’s calculated by dividing the number of unemployed individuals by the total number of people in the labor force. But, this rate can also be deceiving at times.

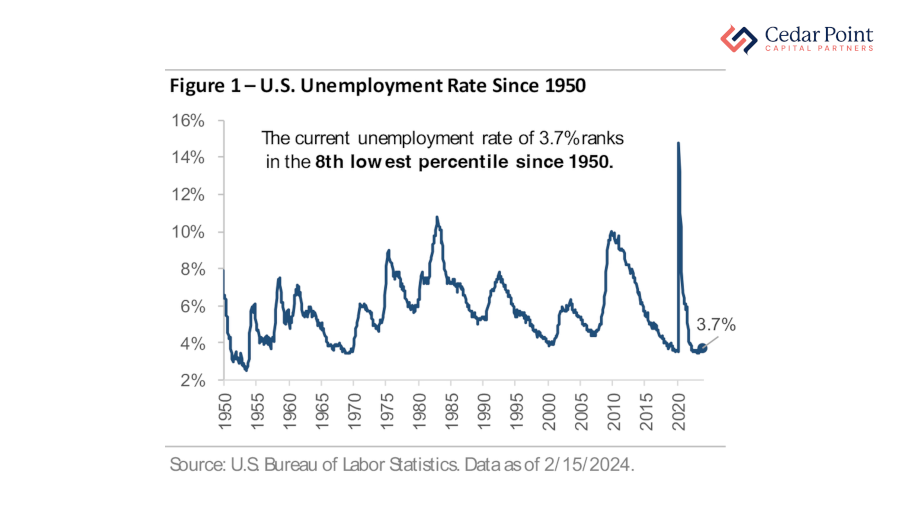

Figure 1 shows current unemployment at 3.7%, that’s historically low. It’s also notable because it goes against a core belief: that higher interest rates cool the economy and increase unemployment.

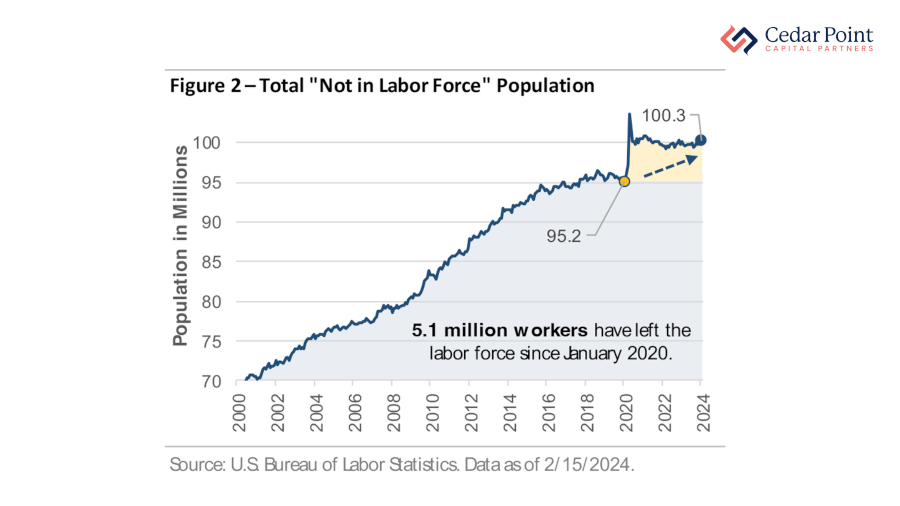

But there’s more to this number than meets the eye. One factor is a group classified as “Not in Labor Force.” This statistic tracks working-aged people not actively seeking work.

Many people left the labor force during the pandemic due to health or childcare challenges, and millions still have not come back. That has left a gap of roughly 5 million workers since January 2020.

Many of those people were 55 and over, meaning they likely accelerated their retirement plans. If they hadn’t retired, the unemployment rate could well be higher today.

This is something of a structural change for our economy and suggests that the labor market could remain tight despite other economic headwinds. Of course, unemployment is a lagging indicator, so it could still rise as higher interest rates have a long-term impact.

Either way, it’s a reminder that while the pandemic has passed, its effects continue to linger.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.