Capital Insights: Why Valuations Matter for Long-Term Performance

Jan 23 2025 | Back to Blog List

VIDEO TRANSCRIPT:

Hi, I’m Trent Von Ahsen, partner with Cedar Point Capital Partners. Welcome to January 2025! We’re excited to share another year of Capital Insights to help you build a more secure and sustainable financial plan.

This month, we’re taking another look at current US stock market valuations, and why they matter when we’re thinking about the long-term performance of your portfolio.

As you may already be aware, by historical standards, the most popular stocks in today’s market are at a minimum, fully priced. The S&P 500 Index has rallied more than 150% since March 2020, and now trades at over 21 times next year’s estimated earnings. As we discussed in last December’s Capital Insights, that’s a level we haven’t seen outside of the 1990s tech boom and the immediate COVID-19 market recovery.

So, why does this matter? Well, history teaches us that while valuations may have a small impact in the short term, they tend to play an outsized role in determining long-term performance, and ultimately investor returns.

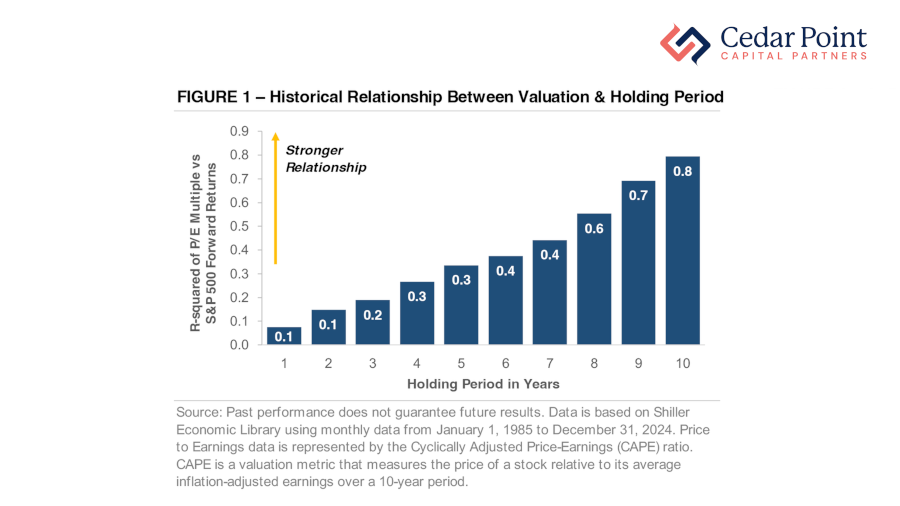

Let’s unpack all of this – take a look at Figure 1.

As we can see in this chart, the horizontal axis represents holding periods, in years, while the vertical axis shows the R-squared value between the S&P 500 Index’s starting valuation and its forward return.

Now, if you’re a little rusty on your statistics, fear not—the R-squared metric demonstrates the predictive relationship between two variables. The story told here is that these R-squared values appear to increase as holding periods increase. Or stated another way, at a holding period of 10 years, nearly 80% of returns in the S&P 500 Index can be attributed to that period’s starting valuation.

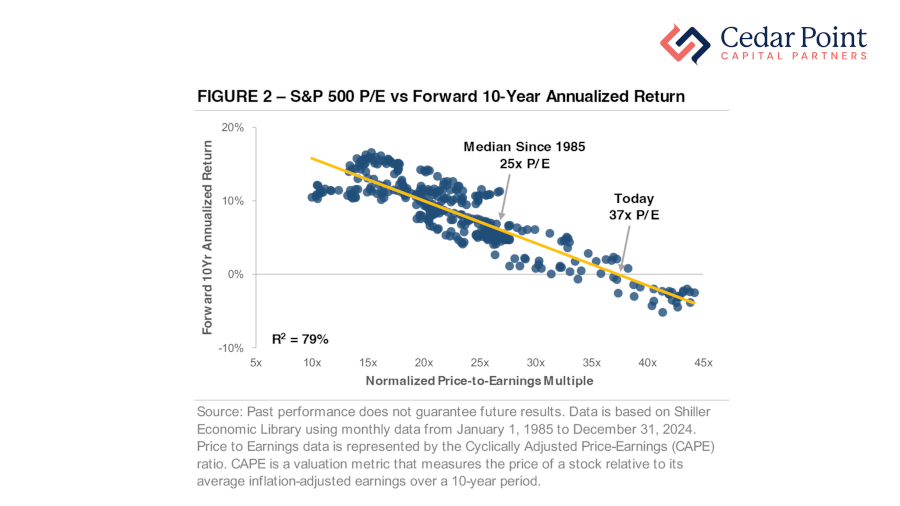

Figure 2 builds on this by plotting the S&P 500 Index’s starting CAPE valuation against 10-year annualized returns.

Here, each data point represents historical Cyclically Adjusted Price-to-Earnings multiples of the S&P 500 Index with actual performance for the proceeding decade. We see a clear relationship develop, exhibited by the sloping regression line: as starting valuations increase, forward 10-year returns tend to decrease. In fact, today’s CAPE ratio of 37 suggests investors could face the prospect of lower returns in the years ahead.

Of course, it’s important to put some context around historical analysis like this. While past performance offers valuable insights, it does not guarantee future outcomes. Given the rarity of today’s starting valuation, it is important to acknowledge the potential impact on forward returns, while not getting scared away from owning equities altogether.

If you have questions about this video or your portfolio, reach out and let’s start a conversation.

My name is Trent Von Ahsen, I look forward to seeing you right here next month for our latest edition of Capital Insights.

Stay curious, stay mindful of your goals, and we’ll see you next time.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.