How to Quit Worrying About Your Financial Future (Retirement Healthcare Edition)

Jun 24 2024 | Back to Blog List

If there’s one thing that Americans have in common these days, it might just be worry.

The latest edition of the American Psychiatric Association’s annual mental health poll, released in May, found that 70% of those polled reported being anxious about current events—in particular, the economy (77%) and the upcoming election (73%). Sound familiar?

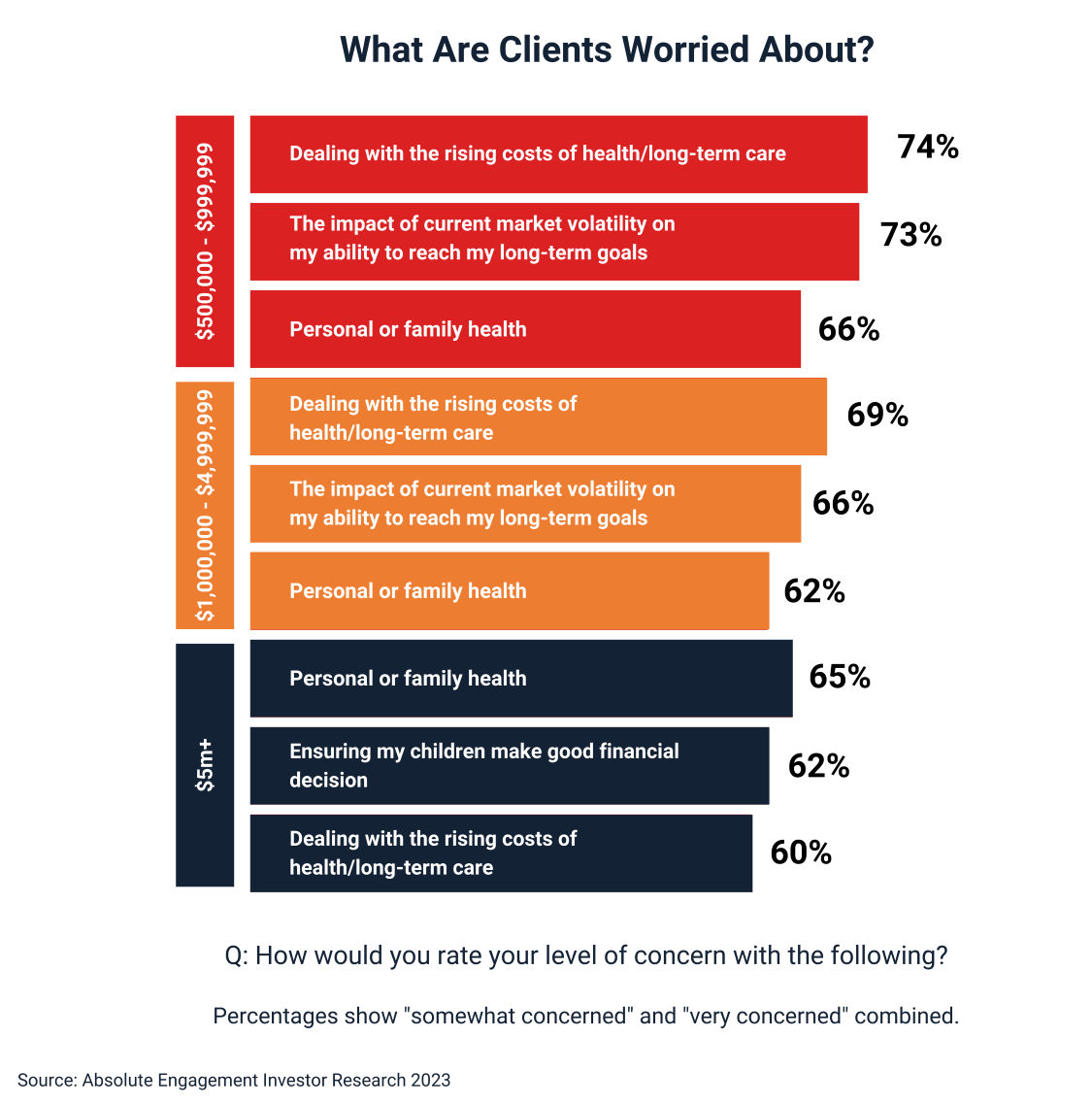

That matches up with other recent research showing Americans at all income levels are feeling stressed about their financial picture. A 2023 survey by fintech company Absolute Engagement found that two-thirds of high-net worth investors are worried about the impact of market volatility on their ability to reach their long-term goals; roughly 70% said they worry about the rising costs of healthcare and long-term care (LTC).

That matches up with other recent research showing Americans at all income levels are feeling stressed about their financial picture. A 2023 survey by fintech company Absolute Engagement found that two-thirds of high-net worth investors are worried about the impact of market volatility on their ability to reach their long-term goals; roughly 70% said they worry about the rising costs of healthcare and long-term care (LTC).

Even among those investors with $5 million or more in investable assets, 60% said they were “somewhat” or “very concerned” about healthcare and LTC costs.

If that’s proof money doesn’t buy you peace of mind, we don’t really know what is. Peace comes from having a solid financial plan covering all aspects of your life, from debt management to tax strategies to estate planning.

It’s why we built our firm on providing a more holistic, fiduciary-grade style of planning and advice to our clients. We can’t eliminate all of your worry, because we’re all human and the world is crazy, but we can provide a framework that accounts for short- and long-term financial contingencies, so you can rest easier knowing it’s all been thought out ahead of time.

Sounds nice, right? But how does it actually work in practice?

The Power of the Plan: Long-Term Care Planning

We’ve previously talked about how a solid financial plan can help you navigate economic challenges from recessions to big stock market swings to high inflation. So let’s focus today on the fears surrounding the costs of advanced healthcare needs, known as long-term care, as an example of how evidence-based financial planning can help you live your retirement years more confidently.

Most of us intuitively understand why it’s so hard to plan and pay for care in our later years. Americans are living longer, medical technology continues to advance, and the new generation of well-appointed senior living facilities are more expensive. But understanding the true impact this all can have on your financial plan takes more data and insight.

For example, consider the fact that someone turning 65 in 2020 had a 70% chance of needing long-term care at some point before their death (per the U.S. Department of Health and Human Services). This care can vary from assistance at home to full-time nursing home care. The average duration of needed help is about three years, but 20% of those requiring care need it for at least five, according to HHS.

At a national monthly median price of $9,733 for a private nursing home room, it’s easy to see how those costs can quickly spiral out of control—and why many people are content to simply hope and pray for good health in retirement.

But here’s the catch: Even good health comes with its own unique financial challenges.

The Society of Actuaries estimates the average cumulative health care expenses for a 65-year-old male in excellent health at $345,000, while for a male in poor health, the estimate is about $246,000. Those in excellent health will spend less annually but more over their retirement due to their longer life expectancies. This means healthier retirees need to plan for higher overall health care costs despite experiencing lower annual expenses in their early retirement years.

And while many people will say, “that’s what Medicare is for,” you should know that Medicare covers only a percentage of your typical healthcare expenses, and only short-term skilled nursing care, not long-term care.

It takes a multifaceted financial strategy to ensure you’ll have the right streams of income and savings to handle the expected and often unexpected care costs that arise in your latest years. These are the kinds of financial plans we create for clients, and they could include a range of strategies:

- Medicare Advantage and Medigap (Medicare Supplement) coverage, which can help cover out-of-pocket costs like copays, deductibles, and coinsurance not covered by Medicare. Note that none of these plans cover long-term nursing home care, although some home care may potentially be covered.

- Long-term care insurance, which is designed to specifically cover the costs of long-term care services. These policies at one time offered generous benefits to policyholders, but have become more limited in recent years as insurers grapple with expensive claims and demographic challenges. With that said, if you’re in generally good health, an LTC policy from a strong carrier may still make financial sense if you need to fill coverage gaps—especially considering that LTC premiums are tax deductible up to $5,880 for those 71 and older (tax year 2024).

- Annuities provide a regular stream of income from an insurance company following either a lump sum or series of premium payments to the insurer. Income payments from annuitization may help cover some long-term care costs. Specifically, deferred long-term care annuities are designed to create flexible options, no matter your outcome. Typically, these types of annuities offer a benefit base, often a multiple of the contract value, which can be used to help pay for long-term care expenses. If no LTC need arises, the contract value remains an asset of the contract owner. Annuities can be complex, however, and have different tax implications depending on your specific type, but we can help you map it all out to ensure it’s working in your best interests.

- Life insurance policies offer several options for funding long-term care expenses, including combination life/long-term care products featuring accelerated death benefits (ADBs). These benefits may allow policyholders to receive tax-free advances on their life insurance death benefits when experiencing a qualifying event. These solutions come with their own costs, but they may be useful if traditional long-term care insurance is no longer viable. You can read more about our take on life insurance in this past Insights piece.

Planning for long-term care costs isn’t just about purchasing an insurance policy and calling it good—it’s about creating a sustainable strategy that ensures your financial security and peace of mind as you age.

Here at Cedar Point Capital Partners, our holistic approach considers all aspects of your financial life, so you have a clear roadmap to navigate the complexities of your life’s different chapters. If you’ve been wanting freedom from financial worry, we can help. Give us a call, and let’s grow together.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.