Making the Most of Equity Compensation

Sep 18 2024 | Back to Blog List

For our clients in the executive and senior management ranks, equity compensation is often a major goal, a career milestone, and a complex tax puzzle.

Being paid in company stock—either in part or nearly all—is a great performance motivator, and companies have several avenues for offering this type of compensation to key employees. Each of those methods comes with unique tax and risk implications, however, which is why understanding and mapping out their impacts on your long-term wealth is essential.

Being paid in company stock—either in part or nearly all—is a great performance motivator, and companies have several avenues for offering this type of compensation to key employees. Each of those methods comes with unique tax and risk implications, however, which is why understanding and mapping out their impacts on your long-term wealth is essential.

This column aims to explain some of the different ways you might be paid with equity, and why it really behooves you to work with a fiduciary adviser who understands your situation and goals. Note that we won’t be talking about employee stock purchase plans (ESPPs), which are another stock-related company benefit, but a topic that we’ll cover in depth in another column.

Different Ways You Might Be Paid in Stock

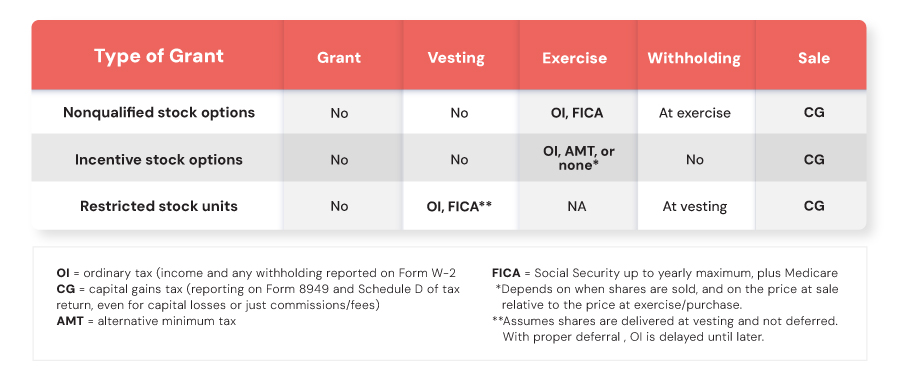

Many people we discuss equity compensation with mention that they have “stock options,” but the actual form of stock option or grant may differ significantly:

- Stock options grant employees the right to purchase company shares at a set price, known as the “strike price,” usually within a specific timeframe. Stock options come in two varieties:

- Non-qualified stock options (NQSOs), where you pay withholding taxes (federal income tax, state income tax, Social Security, and Medicare) at the time of option exercise, along with capital gains on any price appreciation above the exercise price.

- Incentive stock options (ISOs), which qualify for special tax treatment if ISO shares are held for a specific period. Although it is considered income, employees do not have to pay Social Security, Medicare, or withholding taxes.

- Restricted stock awards (RSAs) are a grant of company stock typically given outright after a vesting period. This kind of stock is issued to the employee at the time of grant but held in escrow—meaning you can’t trade or sell it—until the vesting period is over.

- Restricted stock units (RSUs) represent a commitment by the company to award shares at a future date if certain milestones are met, such as staying with the company for a certain amount of time or meeting certain business goals.

RSUs are a popular choice for public companies because they are simpler to administer. They’re also a more straightforward option for employees, since you don’t have to worry about timing your purchase or holding them for a certain period of time, but we see all types of stock-based awards among our clients.

Why Timing Matters in Equity Compensation

Much like life, timing is everything when it comes to managing your equity compensation. You’ll need to understand your vesting schedule and any expiration dates for your options, to start.

Your vesting schedule determines a lot in your compensation plan—it says when you can exercise stock options, when forfeiture restrictions lapse on restricted stock, or when shares are delivered with RSUs. Each grant you receive will have its own vesting schedule and terms, but most will be contingent on your continued employment or service for the company over a specified period; for executives, the vesting schedule may also be tied to specific financial or business goals. Furthermore, your grant can be designed to vest all at once or in pieces, called tranches (e.g. 20% each year for five years).

If you have stock options, such as non-qualified stock options (NQSOs), you can exercise them once they’ve vested—but you don’t have forever to wait. Options have a fixed term—usually 10 years—and expire at the end of that term if unexercised. For example, if your options take three years to vest, you will have seven years to exercise them (provided you keep working for the company).

Stock options typically gain value only if the company's stock price increases, as the exercise price is usually set to match the stock price at the time of the grant. This alignment with stock-price performance is designed to incentivize you by offering the potential for profits based on the success of the company.

After exercise, and if you hold the shares and sell them later at a higher price, you may be able to recognize long-term capital gains tax rates (versus potentially higher ordinary income tax rates) on the appreciation. The longer you hold the stock, the greater the opportunity for additional growth, which can be key to helping you build wealth. The stock could also decrease in value, reducing your gains or even leading to a loss.

With incentive stock options (ISOs), the timing of their sale also plays a critical role due to their unique tax treatment. If you hold your ISO shares for more than one year from the exercise date and two years from the grant date, you may also qualify for long-term capital gains tax rates. However, if you sell your shares too soon, the income could be taxed at a higher rate, and may also trigger alternative minimum tax (AMT). Given these complexities, careful planning with fiduciary wealth manager is essential to avoid unintended tax consequences.

For restricted stock (RSAs or RSUs), the biggest tax implications occur when the shares vest. At vesting, the fair market value of the shares is taxed as ordinary income. Often, taxes are withheld by your employer, potentially withholding shares of the stock, rather than withholding from your paycheck. It is important to be aware of the withholding percentage, as well as your effective tax rate to know whether you should be withholding additional amounts from your paycheck throughout the year to offset.

This is where understanding your overall compensation structure and having a strategy in place is key. If a large portion of your compensation is tied to company stock, you may want to diversify your holdings to avoid being overly reliant on a single asset.

Here is a quick overview of the different stock awards and their tax implications:

It's also important to review your stock plan documents and grant agreements carefully to understand your rights following major events, such as:

- Quitting your job, getting fired, or retiring

- Leaving to work for a competitor

- A change in corporate control (mergers or acquisitions)

- Becoming disabled or dying

In these scenarios, your timing is equally critical, because you may have a compressed window in which to make important financial decisions. For example, many stock option plans give you no more than 90 days to exercise vested options after a job termination, and you may lose your options entirely if you go to work for a competitor.

With restricted stock and RSUs, job termination almost always stops the vesting process, although other life events may accelerate your vesting or let it continue normally. These are all factors that need to be factored into your financial life plan.

Planning Well to Maximize Equity Compensation

Compensation via company stock can be an effective tool for building wealth, but it can also be a challenge to understand and manage as a part of your overall portfolio. That’s what we’re here for.

We specialize in helping you create a holistic financial strategy that aligns your compensation structure with your long-term goals, and navigating questions around the timing of option exercises and the tax implications of vesting shares. We can also help you decide when it makes sense to exercise stock options or sell vested shares.

By considering factors such as market conditions, company performance, and your personal risk tolerance and time horizon, you can make informed decisions that maximize your wealth while minimizing your tax exposure.

Ready to get a handle on your equity compensation package? Give us a call and let’s grow together.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.