Tax Law Changes to Know for 2025

Jan 20 2025 | Back to Blog List

Congratulations, you survived the holidays—ready to dive into tax season?

Yes, we know it’s a bit of an ice bath for the soul (unless you’re a tax policy afficionado, like a few folks in our office), but keeping up with changes to tax code is crucial for optimizing your financial life plan.

Yes, we know it’s a bit of an ice bath for the soul (unless you’re a tax policy afficionado, like a few folks in our office), but keeping up with changes to tax code is crucial for optimizing your financial life plan.

The good news? Most investors will find this year’s tax updates to be positive. Federal changes, including enhancements under the SECURE Act 2.0, are making it easier to save more for retirement, while Iowa’s ongoing income tax rate reduction is making the Hawkeye State an even more affordable place to live and work.

Of course, more changes could be on the horizon, particularly with President Donald Trump and a GOP-controlled Congress ready to revisit tax policy in the coming year. But for now, let’s focus on what’s already in place for 2025 and explore how these updates might affect your financial plan. Remember that every situation is different, so make sure you’re meeting with a qualified tax advisor to discuss yours before the year gets away from us.

2025 Updates from SECURE Act 2.0

The biggest federal tax update for 2025 comes from the law known as SECURE Act 2.0 (or just SECURE 2.0), which was originally passed in 2022 to help Americans save more for retirement.

This year’s update further increases catch-up contribution limits for workers aged 60-63 using employer-sponsored retirement plans like 401(k)s and 403(b)s. Those individuals can now contribute an additional $10,000 or 150% of the standard age catch-up limit, whichever is greater. At age 64, the catch-up contribution reverts to $7,500, the standard catch-up limit for those aged 50 and up.

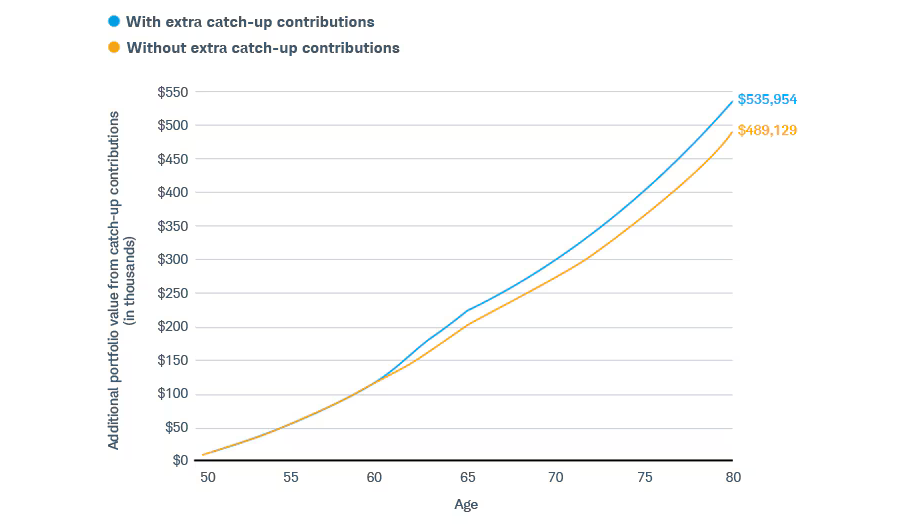

This change means workers aged 60-63 can now defer an additional $11,250 to their account for 2025, above the $23,500 annual deferral limit in place for all retirement plan savers. This enhancement is a powerful savings tool that can add tens of thousands of dollars to your portfolio just in time for retirement (although it’s no substitute for time in the market), as illustrated by the chart below:

‡ Schwab.com. (2024, March 08). How Secure 2.0 Act May Help Boost Your Retirement. Charles Schwab & Co.

‡ Schwab.com. (2024, March 08). How Secure 2.0 Act May Help Boost Your Retirement. Charles Schwab & Co.

Investor 1 (blue) contributes $7,500 annually from ages 50 through 59 and 64 through 65, and $11,250 annually from ages 60 through 63. Investor 2 (orange) contributes $7,500 annually from ages 50 through 65. Assumes 6% annual portfolio growth for both investors. The option to make larger catch-up contributions for those ages 60 through 63 will begin in 2025. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product. Dividends and interest are assumed to have been reinvested, and the example does not reflect the effects of taxes or fees.

It’s worth noting that this catch-up change is optional for employer-sponsored plans, so your specific plan may not offer this enhanced opportunity—even though there’s little reason for them to not do so. Make sure to check with your plan administrator for confirmation.

SECURE 2.0 previously updated the IRA catch-up contribution limit for individuals aged 50 and over to include an annual cost-of-living adjustment, but it remains $1,000 for 2025.

One provision originally scheduled for 2024 but now delayed until 2026 affects 401(k) (or similar workplace retirement plans) catch-up contributions for high earners—in this case, those who made $145,000+ in the previous year. While catch-up contributions are still allowed for this group, they must be made on a Roth (post-tax) basis rather than pre-tax.

This change means higher-income earners will no longer be able to defer taxes on their catch-up contributions, but it also comes with some potential benefits. For one, because taxes are prepaid, you won’t owe taxes when you withdraw the money in retirement. Additionally, prepaying taxes on these contributions now could reduce the size of your tax-deferred accounts, potentially lowering your required minimum distributions (RMDs) later.

One other notable provision going into effect this year is the requirement that most new employer-sponsored retirement plans automatically enroll employees. Under SECURE 2.0, companies launching new 401(k) or 403(b) plans must automatically enroll employees at a minimum deferral rate of 3%, with an automatic annual increase of 1% until the deferral rate reaches at least 10%. Employees will still have the option to opt out or adjust their deferral rates.

For our entrepreneurial clients, this new automatic enrollment mandate represents both a compliance challenge and an opportunity to foster better retirement savings habits among employees. Don’t worry if this seems onerous—our team can help you navigate the administrative complexities of your 401(k) plan and ensure a smooth transition to these new requirements.

Iowa’s Tax Rate Drop Continues

While SECURE 2.0 has made it easier for older workers to catch up on their retirement savings, a lower tax rate here in our home state of Iowa stands to make saving easier for everyone.

As of January 1, 2025, Iowa taxpayers are now paying a flat income tax of just 3.8%. That’s down from last year’s (still progressive) system of income taxation that capped out at 5.7%.

For an Iowa taxpayer making $150,000, that’s potentially more than a couple thousand dollars back in your pocket this year compared to last. That’s real money you can put to work in your portfolio, use to pay down debt, or accomplish any other financial resolutions you made for 2025.

This year marks the final planned rate drop here in Iowa, although some politicians in the state have turned their attention toward eliminating the state’s income tax entirely. While that's unlikely in the near term, state legislative leaders have said they do plan to address property tax relief—an important issue for many Iowans, especially those living in high-tax school districts like you’ll find here in the Corridor.

Bringing it All Together

This year’s tax changes present some exciting opportunities to optimize your financial life plan, whether through enhanced retirement savings limits or capitalizing on state-level tax reductions. But they also underscore the importance of proactive, holistic planning.

SECURE 2.0, for example, ushered in more than 90 provisions changing everything from required minimum distributions (RMDs) to 529 education savings plans. You need a knowledgeable team able to distill and understand all of those changes, and then leverage them for your strategic benefit. It’s difficult, complex work that takes time—which is why consulting with your financial adviser early is essential.

Ready to start your estate and tax planning journey with a team that actually understands taxes? Reach out to us today and let’s have a conversation about how we can help set you up for success in the year ahead.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.