Tax Loss Harvesting: A Primer for Investors

Nov 19 2024 | Back to Blog List

When it comes to your investment portfolio, tax efficiency is an often-overlooked measure that can make a significant difference. One strategy that can help you keep more of your money is tax loss harvesting.

While the concept may seem complex or even undesirable—who wants to take a loss?—it’s really just about converting investments that have lost value into something much more useful: a tax off-set asset capable of counteracting other realized capital gains and potentially lowering your overall tax liability into the future.

While the concept may seem complex or even undesirable—who wants to take a loss?—it’s really just about converting investments that have lost value into something much more useful: a tax off-set asset capable of counteracting other realized capital gains and potentially lowering your overall tax liability into the future.

Here at Cedar Point Capital Partners, our focus on tax efficiency and holistic financial planning means we use every tool available to us to maximize your net returns, and that includes strategic tax loss harvesting (TLH).

But what exactly is TLH and how does it work? Here, we’ll break down how tax loss harvesting works, when it might be most effective, and how to avoid potential pitfalls. Remember, as with all tax-related strategies, consulting a professional is key to tailoring it to your unique situation.

What is Tax Loss Harvesting?

At its core, tax loss harvesting is the practice of selling assets that have lost value to realize a capital loss. Those losses are used to offset your capital gains for the year, with short-term losses first canceling out short-term gains and long-term losses eliminating long-term gains. If your losses exceed your capital gains for the year, you may be able to then use that loss to reduce your taxable income by up to $3,000 (or $1,500 if married filing separately).

Better yet, if your net loss is more than $3,000, you can defer that loss forward to future tax years until you’ve used up the entire loss. Based on the size of that loss, this carry-forward deduction can continue for many years, making it a powerful tool for reducing long-term tax liabilities—especially if you anticipate being taxed in a higher bracket in the future.

How does tax loss harvesting work in practice? Suppose you invested in a tech stock that initially performed well, but recently dipped below your purchase price. If you sell this stock at a loss, you can use that loss to offset gains from other investments.

Let’s say you’ve realized $5,000 in gains from other stocks this year; selling your tech stock at a $2,000 loss reduces your total capital gains for the year to $3,000, helping you pay less in taxes.

If you instead took a $10,000 loss on your tech stock, selling this year would cancel out your $5,000 in capital gains and potentially erase another $3,000 from your taxable ordinary income. It would also leave $2,000 in capital losses that could be used to offset capital gains or held against ordinary income in future years.

Proceeds generated by your realized loss transaction could then be invested into similar stocks or ETFs, allowing you to return to generating more capital growth through the law of compounding. Although, it’s important to choose your new investments wisely to avoid running afoul of IRS regulations on what you can buy and when. (More on that in a bit.)

Who Can Benefit from Tax Loss Harvesting?

The benefits of tax loss harvesting can be significant, but that doesn’t mean it’s the right strategy for every financial situation.

First off, TLH as a strategy only applies to capital assets, like securities held in taxable brokerage accounts, and not tax-advantaged, qualified accounts like IRAs or 401(k)s. That’s because the growth in those accounts is not subject to taxation until funds are withdrawn; without any capital gains to offset, there’s no benefit to harvesting your losses.

For those primarily saving for retirement, the focus is usually on maximizing contributions to tax-sheltered accounts. However, once these options have been fully used up, TLH can become a valuable strategy in taxable accounts to help manage annual tax bills and maximize after-tax returns.

The nature of tax loss harvesting also favors certain types of investors. While nearly anyone with taxable investments can stand to gain from this strategy, TLH is most beneficial for those with investments that may generate significant capital gains or losses. To best maximize the potential opportunities, a certain level of market and sector volatility is needed to take advantage of TLH’s episodic nature as price action recalibrates and subsets of the overall market come in and out of favor.

Timing Losses and the Wash Rule

The basic concepts behind tax loss harvesting are straightforward, but the true value of this strategy lies in the timing.

Perhaps the biggest timing consideration with TLH–and an area where many investors go astray–is the IRS’s Wash Rule, which says that investors cannot repurchase a “substantially identical” security within 30 days (before or after) of selling it for and realizing a loss. That means you will need to avoid buying the same or a highly similar investment within that window, or the IRS will disallow your claimed capital loss.

Some investors are content to simply sit on that cash and then repurchase the stock or fund they sold at a loss after the 30 days is up—but that approach could easily leave you on the sidelines if markets rally. That’s why we emphasize the importance of pre-sale research and analysis, so you have a plan for replacing that asset with a similar (but not identical) investment that offers the same return potential and sector allocation.

If you’re selling shares in an ETF or mutual fund, look for another fund with a similar, but slightly different investment approach within the same asset class. Similarly, you could consider selling an individual stock at a loss and reinvesting the proceeds in an ETF that covers the same sector or theme, helping you maintain some exposure while avoiding a wash sale.

Be aware that reinvested dividends can also inadvertently trigger the wash sale rule if those reinvestments occur within the 30-day window. And don’t forget to be mindful of buying identical securities in different accounts you control, such as a retirement account or a joint account, within the 30-day window, as these transactions can also set off a wash sale.

When it comes to timing and TLH, it’s also important to think year-round, not just end of the year, like many investors do. Saving your loss harvesting efforts for Q4 ignores other opportunities that present themselves through the year. Market volatility can occur in any season, with the ability to create temporary losses on paper; astute investors and investment advisers remain on the lookout for opportunities to book a strategic loss that can pay off into the future.

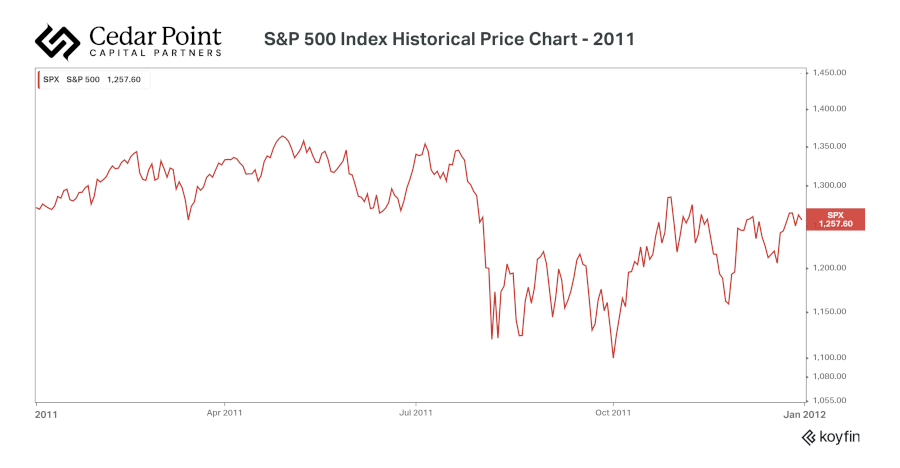

For instance, in 2011, the S&P 500 Index was down more than 10% at mid-year, but finished up 2% (when including dividends). As you can see in the chart below, investors harvesting only at the end of the year would have been left without losses to harvest, but those acting in June and July could have still generated TLH benefits.

Note that this isn’t about “timing the market” and trying to sell your stock at just the perfect time—it’s about setting limits and price levels that align with your risk tolerance and time horizon, and selling automatically when you get there. The idea is to get rid of the market watching and all the anxiety that comes with it by knowing you have a reasoned plan guiding your buying and selling decisions. The right financial partner can help you do just that.

At Cedar Point Capital Partners, we work closely with clients to develop comprehensive tax strategies, including tax loss harvesting. We evaluate your unique circumstances, tax bracket, and life goals to maximize the benefits of TLH without compromising your overall portfolio strategy. If you’re ready to leverage this powerful tactic for reducing your tax liability and building wealth, reach out to us today and let’s grow together.

The commentary on this blog reflects the personal opinions, viewpoints, and analyses of Cedar Point Capital Partners (CPCP) employees providing such comments and should not be regarded as a description of advisory services provided by CPCP or performance returns of any CPCP client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Cedar Point Capital Partners manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.